Does the company's profit and loss affect personal welfare?

The benefits received by individuals, such as Working for Families, are related to family income, while the company is an independent individual, so the company's profit and loss has nothing to do with the family and the individual, and will not affect the personal welfare.

Don't have an employee to pay ACC?

Yes, although a company may not employ employees, but the shareholders and directors run the company, which are actually equivalent to the employees of the company, and receive the wages of shareholders, then the company is subject to ACC even if it has employees.

What is Business name and Trading name? Do I need to register?

Business name is a company name that needs to be officially registered with the Company Office. The trading name can be understood as the name used by the company in order to make it easier for customers to remember when doing business, and it does not need to be registered, but in order to avoid being maliciously used by other merchants with the same trading name, it can be protected by registering and applying for a trademark.

How do I determine if I am a New Zealand tax resident?

关The main question about determining a tax residency in New Zealand is the 183-day rule, or determining whether you have a permanent place of Abode in New Zealand. As for having New Zealand citizenship, having a bank account in New Zealand, paying KiwiSaver, etc., are factors that will be considered when determining whether you have a permanent relationship in New Zealand, but they are not absolute factors, and you need to consider your other conditions comprehensively.

What should I do if the company forgets to do the annual examination and the company registry shows overdue?

If the Registrar of Companies shows this information, it needs to be submitted to the company's annual review as soon as possible, and if it is not processed, the company will be forcibly deregistered. If the company has unresolved tax issues, it will also face the post-autumn settlement of the tax office.

I came to New Zealand for tourism, deposited a sum of money in the bank, and then returned to China, do I need to pay interest tax in this case?

Yes, the bank will charge an interest tax. If you are not a New Zealand tax resident, you can apply for NRWT or AIL from your bank, which is a lower interest tax. The rate of AIL here is only 2%, which is lower than NRWT, and for countries that have signed DTA, this part of the tax is not deductible when filing a tax return in the country where the depositor is a tax resident, but NRWT can. However, if you are a New Zealand tax resident, you will choose RWT based on your annual income.

Do overseas nationals have to pay tax on their income in New Zealand?

Depending on the circumstances, overseas nationals are not tax residents of New Zealand. If you are a New Zealand tax resident, you need to declare not only New Zealand income, but also overseas income; If you are not a New Zealand tax resident, you only need to report your New Zealand income to the Inland Revenue Department.

If a company does not have a registered business address, can it be found only by knowing the names of the company's directors?

There is currently no way to find out the business address of a company by the name of its directors.

If the registered address of a company (such as a restaurant) is different from the business address, how can I find out the real business address?

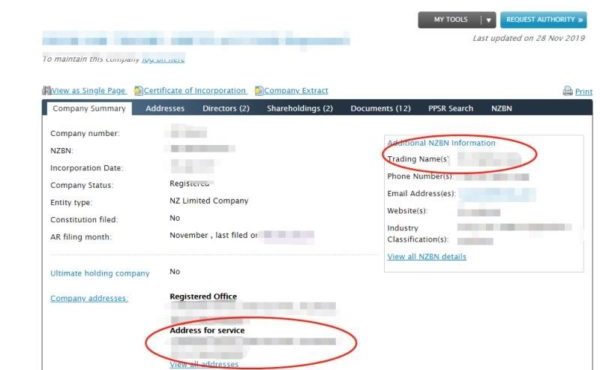

Normally, the restaurant address is displayed in the Company Office at Address for service, as shown in the following image. If the address displayed is incorrect, it may be because the registrant has not completed the company information and there is no other way to check it, but you can also try to use Google to do a fuzzy query through the Trading name (if any). You can see the company's trading name as shown in the image below, but if you don't provide it, it's hard to find it in any other way.

Is there any tax on the Guaranteed Childcare Assistance Payment (GCAP)?

In general, most benefits in New Zealand are paid after tax deductions. And GCAP money is generally paid directly to the early childhood education center, not directly to the parents.

How do I apply for a temporary loss carry-back?

Log in to myIR, click on "Income Tax" and click on "I want to..." in the top right corner. Select "Opt-in to carry-back loss" to go to the application page. There are two years to choose from, which are FY18-19 and FY19-20. Assuming that the loss is incurred in 2020, and the 2019 is a profit and income tax has been paid, then the loss in 2020 can be deducted from the profit in 2019 in this way, and the income tax paid will be refunded. If there will be a loss in 2021, the profit in 2020 can also be deducted in this way and the corresponding income tax will be refunded.

I am a tax resident of New Zealand, what tax is deducted from my bank after receiving interest income from my bank deposits?

This is a tax known as Resident Withholding Tax (RWT), where banks are obliged to withhold certain investment income, such as interest or dividends. You can choose the RWT ratio from the following ratios of 10.5%, 17.5%, 28%, 30%, 33%, depending on your annual income.